Phil Erlanger Research Co.

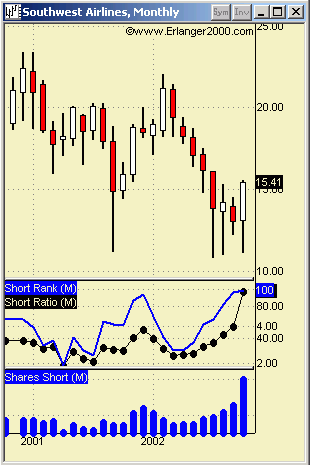

Short Interest Ratio

The traditional calculation of "Days to Cover," but with a twist. The Erlanger Short Ratio is calculated using the same variables monthly number of shares short divided by the average daily volume.

Erlanger uses a 12-month weighted average daily volume instead of the

traditional 20 days. This allows a smoother calculation and avoids misleading

ratios during volatile market conditions and individual anomalies like analyst

recommendations and earnings reports. The Erlanger Short Ratio will change on a

monthly basis as the new short interest numbers are released.

The traditional calculation of "Days to Cover," but with a twist. The Erlanger Short Ratio is calculated using the same variables monthly number of shares short divided by the average daily volume.

Erlanger uses a 12-month weighted average daily volume instead of the

traditional 20 days. This allows a smoother calculation and avoids misleading

ratios during volatile market conditions and individual anomalies like analyst

recommendations and earnings reports. The Erlanger Short Ratio will change on a

monthly basis as the new short interest numbers are released.