Phil Erlanger Research Co.

Value Lines

ALERT UPDATE:

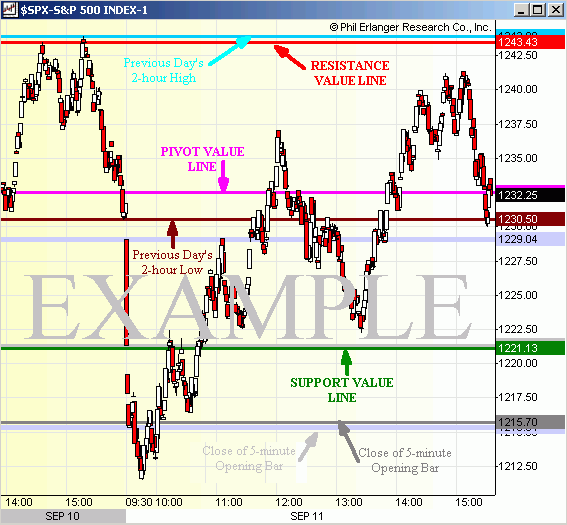

Erlanger Value Lines are designed to identify key levels for the intraday trader. These levels fall into three categories: Support/Resistance, Extreme, and Opening values. From a practical point of view, these levels act as targets and triggers for short-term trades. It is uncanny how these levels stop or turn back short-term price swings.

Support/Resistance levels are re-calculated each day based upon the previous day's trading. There are three lines in this category: support, resistance and pivot.

Extreme levels reflect the final 2-hour high and final 2-hour low from the previous day's trading.

We also calculate the close of 1 minute and 5 minute bar on the open.

EXAMPLE: